Introduction

The North American Free Trade Agreement (NAFTA) entered into force in January 1994. NAFTA’s seek for the elimination of most tariffs on products traded among the three countries Canada, Mexico, and the United States.

The major focus was on the liberalization of trade in agriculture, textiles, and automobile manufacturing. It also included the protection of intellectual property and implementing labor and environmental safeguards.

For Mexico the trade represented the opportunity to generate steadier economic growth providing new jobs and opportunities to reduce illegal emigration. Mexican President Carlos Salinas de Gortari underlined the opportunity to modernize the Mexican economy to “export goods, not people.”

For the United States and Canada, Mexico was seen as a promising new market for exports and as a lower cost investment location that could enhance the competitiveness of U.S. and Canadian companies

Background

President Trump announced his desire to eliminate the NAFTA in order to protect the scape of investments and the loose of domestic jobs. After the confirmation that the US will quit the Trans-Pacific Partnership, trade concerns about the NAFTA’s future arises. At the end of April and during a phone call Donald Trump agreed with Mexican and Canadian leaders to not to pull out of NAFTA “at this time”.

“The U.S. administration has not indicated how it intends to pursue the objective but would presumably seek to use the renegotiation primarily to reduce the bilateral deficit with Mexico, which totaled $63 billion in 2016 (far less than with China but about the same as with Japan and Germany ). The trade with Canada is close to balance”. (C. Fred Bergsten; Peterson Institute for International Economics.)

“In 2014, the more valid value-added measure of the bilateral US deficit with Mexico was about one-third lower than the traditional measure of the deficit”. (Bown and Johnson 2017).

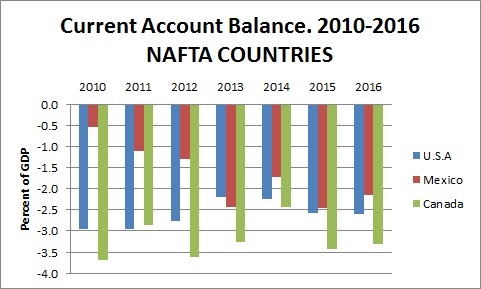

Canada and Mexico globally have account deficits, despite the latter’s bilateral surplus with the United States. “The deficits of both countries have in fact been larger than that of the United States in three of the last four years” (C. Fred Bergsten; Peterson Institute for International Economics.) This statement can only be considered when comparing the deficits as a percent of GDP (as in figure 1). Using GDP as a common factor that implicit considers the different capabilities of each country (since larger economies may be better suited to handle large deficits and surpluses).

The deficit for Mexico has increased steady since 2010-2013 almost fourfold (-0.53% in 2010 to -2.42% in 2013), in comparison with U.S.A and Canada in which the deficit has been almost steady. Source: International Monetary Fund. Principal Global Indicators.

Most economists agree that NAFTA provided benefits to the three involved economies. But experts also say that it is difficult to identify the direct effects. Factors such as rapid technological changes, large trade with other countries such as China, and domestic developments make it more difficult to quantify the real effects from NAFTA.

So far, the main debate about NAFTA’s efficacy has been focused in employment, effects in key industries and improvements in the Production process. A nice example is the strong cooperation of the Canadian Bombardier in Mexico. In 2011 Bombardier Aerospace announces a $50 million investment to support the manufacturing of the craft fuselage of its new Global 7000 and Global 8000 business jets in Querétaro, Mexico. In 2012, Bombardier Transportation celebrates 20 years of quality manufacturing and leadership in passenger rail transportation in Mexico and acquired a contract with STE (Mexican Secretary of Transportation) to design, manufacture and put into service light rail vehicles for Mexico City. (Source: Bombardier.com)

Figure 1

Source: International Monetary Fund. Principal Global Indicators.

The deficit for Mexico has increased steadily since 2010-2013 almost fourfold (-0.53% in 2010 to -2.42% in 2013), in comparison with U.S.A and Canada in which the deficit has been almost steady. Source: International Monetary Fund. Principal Global Indicators.

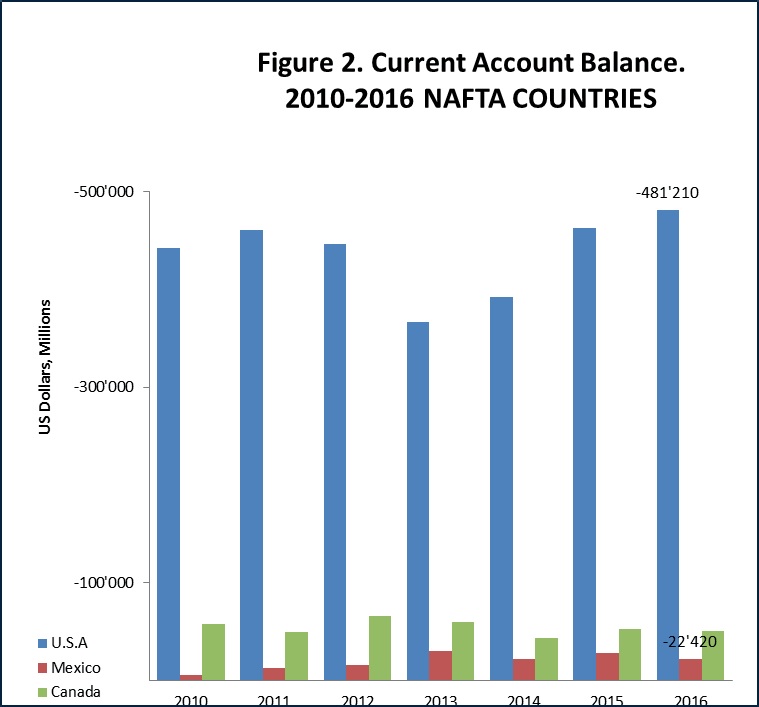

Figure 2

Source: International Monetary Fund. Principal Global Indicators.

The conclusions can look different if we analyze the same account balance in US Million Dollars (figure 2).

In which we can identify the increasing U.S. deficit reaching US 481,210 Million in 2016.

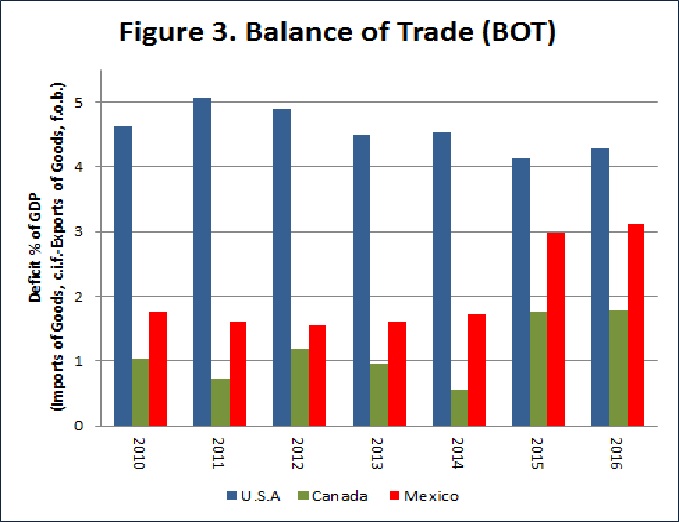

Figure 3

Source: International Monetary Fund. Principal Global Indicators.

While comparing the Balance of Trade (figure 3) from the NAFTA countries: it can clearly be identified the Mexican increasing deficit over the last 3 years, and the steadily Canadian performance.

NAFTA REALITY

Since NAFTA, U.S. trade with its North American neighbors has more than tripled, growing more rapidly than their trade with the rest of the world. U.S exports to Canada and Mexico represent more than a third of the global total. Critics of the deal, however, argue that it is to blame for job losses and wage stagnation in the United States, driven by low-wage competition, lower costs production in Mexico generating a trade deficit. Nevertheless, NAFTA provided benefits that are observed in specific industries: the U.S. Automobile industry was able to keep competitive and maintain domestic jobs while NAFTA provided the creation of a cross-border supply chains. Estimations showed that some fourteen million jobs rely on trade with Canada and Mexico.

But, not everything is only related to the NAFTA. The increasing competition with China entering the WTO also impacted the reduction in U.S. manufacturing jobs. Hanson, an economist and trade expert at the University of California, San Diego stated: “China is at the top of the list in terms of the employment impacts that we found since 2000, with technology second, and NAFTA far less important,” In 1989 the Canada-U.S. Free Trade Agreement (CUSFTA) made the U.S. Canada’s largest trading partner. Since the NAFTA, cross-border investment increased. Canada mainly benefits in the agricultural exports to U.S. Canada’s total agriculture exports to NAFTA partners tripled since 1994.

Canadian manufacturing employment held steady. As well its Balance of Trade (figure 3)

During the presidential period of President Salinas de Gortari (1988 to 1994) Mexico started an economic liberalization (the banking system was privatized, as well as the national phone company TELMEX). Transforming the country from one of the world’s most protectionist economies to one of the most open to trade. Important reforms were implemented which allowed reducing public debt, introducing balanced budget rule, stabilizing inflation, and built up the country’s foreign reserves.

Nevertheless, NAFTA did not provide the expected promises for Mexico: Economic growth, raise wages, and reduce emigration. Comparing these factors with other Latin American countries like Chile and Brazil; Mexico presented a lower performance. NAFTA allowed the Mexican farm exports to the United States, but also generated unemployment in the sector, especially corn producers while competing with subsidized products. “U.S. may have faced job losses in the manufacturing (Automobile industry), but it has had significant benefits for the American agricultural sector. US exports of agricultural products to Mexico have increased nearly fivefold since NAFTA. Mexico imports 23% of the 320 million metric tons produced and around 98% of the corn that forms a staple of the Mexican diet comes from U.S.” Why reshaping NAFTA could be good for Mexico; Cecilia Tortajada; WEF Forum. NAFTA influenced Mexico in two different directions, generated the growth of foreign investment in the north part of the country while negative affecting south agrarian area. Mexican economy was also impacted by non-NAFTA factors. The 1994 devaluation, China’s low manufacturing costs, land reforms made that made it easier for farmers to sell their land and emigrate. As UCSD’s Hanson expressed.

In 1989 the Canada-U.S. Free Trade Agreement (CUSFTA) made the U.S. Canada’s largest trading partner. Since the NAFTA, cross-border investment increased.

Canada mainly benefits in the agricultural exports to U.S. Canada’s total agriculture exports to NAFTA partners tripled since 1994.

Canadian manufacturing employment held steady. As well its Balance of Trade (figure 3)

During the presidential period of President Salinas de Gortari (1988 to 1994) Mexico started an economic liberalization (the banking system was privatized, as well as the national phone company TELMEX). Transforming the country from one of the world’s most protectionist economies to one of the most open to trade. Important reforms were implemented which allowed reducing public debt, introducing balanced budget rule, stabilizing inflation, and built up the country’s foreign reserves.

Nevertheless, NAFTA did not provide the expected promises for Mexico: Economic growth, raise wages, and reduce emigration. Comparing these factors with other Latin American countries like Chile and Brazil; Mexico presented a lower performance.

NAFTA allowed the Mexican farm exports to the United States, but also generated unemployment in the sector, especially corn producers while competing with subsidized products.

“U.S. may have faced job losses in the manufacturing (Automobile industry), but it has had significant benefits for the American agricultural sector. US exports of agricultural products to Mexico have increased nearly fivefold since NAFTA. Mexico imports 23% of the 320 million metric tons produced and around 98% of the corn that forms a staple of the Mexican diet comes from U.S.” Why reshaping NAFTA could be good for Mexico; Cecilia Tortajada; WEF Forum.

NAFTA influenced Mexico in two different directions, generated the growth of foreign investment in the north part of the country while negative affecting south agrarian area.

Mexican economy was also impacted by non-NAFTA factors. The 1994 devaluation, China’s low manufacturing costs, land reforms made that made it easier for farmers to sell their land and emigrate. As UCSD’s Hanson expressed.

Opportunities

The 23 years old agreement has certainly room to be improved. Much of the debate has centered on how to mitigate the negative NAFTA effects. But, we should also consider the potential of positive changes. The fast development of technology, electronic data transfer, simplification of duty processes, global trade speed. But also, sustainable management and environmental regulations could also be included in the negotiation agenda.

Some of the main areas in which the NAFTA can be improved are:

Energy: In 2013, the Mexican constitution was amended to allow foreign investment in oil and natural gas exploration. Renewables represent an interesting opportunity. If for example the NAFTA countries could lower the regional energy costs, to industry and consumers, they could position the region at a significant economic advantage over Asia, Europe and other parts of the world.

Recently President Merkel welcomed the fact that sectors like energy could be included in the NAFTA reevaluation. Sectors opened in 2013, post-NAFTA, in which oil and gas market can be considered for private investment.

Infrastructure investments: Improving the delivery of goods and diminish border crossing lines by combining technology and capital.

Further focus in the development of the core business of each country to improve the cross-country value chain stay competitive with Europe and Asia.

And not least, working out the immigration problematic, implementing updated technology to improve the documentation of the people and secure flow of labor and labor conditions.

Challenges and Risks

Mexico upcoming presidential elections (July 2018) for which President Enrique Peña Nieto, can’t run again because of term limits, therefore negotiations may have to be continue or be restarted with his overtaking president.

U.S. Danger of losing more trade. If other countries are angered by the construction of the wall or the imposing of tariffs to Mexican products. Negative reactions could be demonstrated by imposing similar tariffs on American imports, this could lead to a further reduction for U.S. exports worldwide.

Imposing tariffs in the automobile industry will not only reduce the regional global competitiveness, but also worldwide suppliers for example German producers in Mexico.

Also, imposing tariffs on U.S. agricultural products exports (free tariff by now) would reduce the Mexican demand which would certainly reduce both the jobs and income of the farmers, as well as America’s annual gross national product (GNP) or Mexican to look for other trade Partner (Brazil) And in the other hand, import tariff would cause Mexican/ Canadian products to become more expensive for American consumers.

“I’m sure the apple guys from Washington State or the corn guy from Iowa will not like tariffs on corn or apples,” says Mexico’s economy secretary Ildefonso Guajardo. “It’s not in the best interest, neither of the United States nor Mexico, to reintroduce tariffs.”

The renegotiations

All three governments agreed that the agreement needs to be updated.

The process for making big changes to NAFTA has started. On February 3rd the Mexican government began a 90-day consultation with businesses on what its negotiating position should be. Only after those 90 days are over can the U.S., Mexico and Canada sit down for talks. Formal talks between the United States, Canada and Mexico are expected to begin from around mid-August.

But renegotiation will be challenging with Mr. Trump clear position. Not only, the damaged relationship with Mexico by insulting migrants and demanding that Mexico pay for a border wall. His intention to impose tariffs as high as 35% on Mexican cars, and clear intentions to defend local investments, jobs without considering global macroeconomic factors.

Wilbur Ross, who will lead the U.S. negotiators, confirms NAFTA is “logically the first thing for us to deal with”. Ross appears focused more on improving NAFTA by tightening rules of origin and adding chapters on trade favorable to the U.S. And during a press conference in Washington said that the U.S. might renegotiate separately with each of the countries: Canada and Mexico.

“Any agreement can be improved,” said David MacNaughton, Canada’s ambassador to the United States, the day after Mr. Trump won the election. The 23-year-old agreement could be modernized in ways that benefit the United States.

Conclusions

Even though, President Trump opened the Pandora box. It generated the opportunity to identify the vulnerability of each of the three countries and its dependence in the NAFTA. It is clear demonstrated that in a certain extend each country has profited since the agreement enter in force.

As in Economy, not only forecasts and statistical calculations can predict the results of a Trade agreement. Macro-external factors may influence the global development. U.S. has to open their view, and consider the global picture. Meanwhile Mexico and Canada should keep working in lowering its dependence to U.S. and looking to alternative potential markets like Asia and Europe.

We strongly hope that the negotiation seeks for trade simplification, economic growth and social development.

NAFTA 2.0 can also be a promise for the region, though negotiations won’t be easy, but when thinking it well, this can boost the region’s economy.

Sources:

https://piie.com/events/positive-nafta-renegotiation

https://www.reuters.com/article/us-germany-mexico-idUSKBN19106Ghttp://www.economist.com/news/americas/21716660-revision-north-american-trade-deal-will-not-give-donald-trump-what-he-wantshttp://thecorner.eu/financial-markets/after-nafta-new-trade-opportunities-mexico/62933/https://www.weforum.org/agenda/2017/04/why-reshaping-nafta-could-be-good-for-mexicohttp://money.cnn.com/2017/04/07/news/economy/mexico-nafta-economic-minister/index.htmlhttp://thehill.com/blogs/congress-blog/economy-budget/317401-renegotiating-nafta-provides-an-opportunity-to-make-needed